Wednesday, December 3, 2008

Seminar: Murray

Monday, December 1, 2008

Krugman on Deficits and the Future

Deficits and the Future

By PAUL KRUGMAN

Published: December 1, 2008

Economists worry that large budget deficits will burden future generations. But strong fiscal expansion would actually enhance the economy’s long-run prospects.

http://www.nytimes.com/2008/12/01/opinion/01krugman.html

Wednesday, November 26, 2008

The Girl Effect

Or you could just give the world cable TV. At least according to this paper by Jensen and Oster.

Cable and satellite television have grown rapidly throughout the developing world. The availability of cable and satellite television exposes viewers to new information about the outside world, which may affect individual attitudes and behaviors. This paper explores the effect of the introduction of cable television on gender attitudes in rural India. Using a three-year individual-level panel dataset, we find that the introduction of cable television is associated with improvements in women's status. We find significant increases in reported autonomy, decreases in the reported acceptability of beating and decreases in reported son preference. We also find increases in female school enrollment and decreases in fertility (primarily via increased birth spacing). The effects are large, equivalent in some cases to about five years of education in the cross section, and move gender attitudes of individuals in rural areas much closer to those in urban areas. We argue that the results are not driven by pre-existing differential trends. These results have important policy implications, as India and other countries attempt to decrease bias against women.

Tuesday, November 25, 2008

Turkey Shortage?

Thursday, November 20, 2008

Seminar: Murray

The details were supposed to be:

Our next seminar speaker will be Professor James Murray, Assistant Professor of Economics, Viterbo University. James is a UWL graduate (econ major). He finished his PhD at Indiana University and recently accepted a tenure track position at Viterbo University. He will present “Initial Expectations in New Keynesian Models with Learning,” on Friday, November 21st, at 3:30 p.m. in room 230. The paper can be accessed at http://www.murraylax.org/research/murray_initexp.pdf. Please invite your upper division students. I look forward to seeing you at the seminar.

Wednesday, November 19, 2008

Mitt Romney: Let them eat cake!

Wednesday, November 12, 2008

Google Flu Trends

In early February, for example, the C.D.C. reported that the flu cases had recently spiked in the mid-Atlantic states. But Google says its search data show a spike in queries about flu symptoms two weeks before that report was released. Its new service at google.org/flutrends analyzes those searches as they come in, creating graphs and maps of the country that, ideally, will show where the flu is spreading.

The C.D.C. reports are slower because they rely on data collected and compiled from thousands of health care providers, labs and other sources. Some public health experts say the Google data could help accelerate the response of doctors, hospitals and public health officials to a nasty flu season, reducing the spread of the disease and, potentially, saving lives.

“The earlier the warning, the earlier prevention and control measures can be put in place, and this could prevent cases of influenza,” said Dr. Lyn Finelli, lead for surveillance at the influenza division of the C.D.C. From 5 to 20 percent of the nation’s population contracts the flu each year, she said, leading to roughly 36,000 deaths on average.

The NYTimes graphic is here and more importantly the data is here . The data would make an excellent weekly instrumental variable for certain activity.

Monday, November 10, 2008

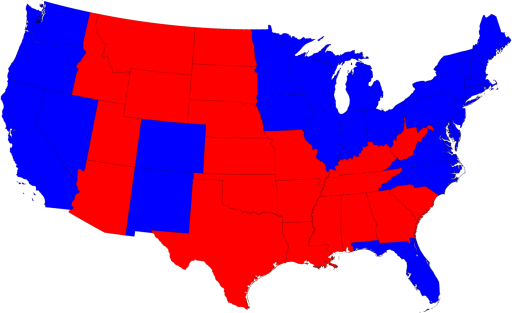

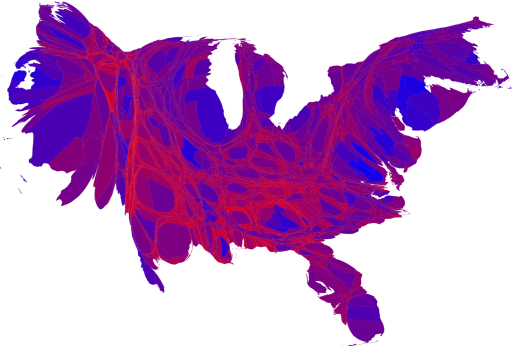

Visualizing the Election

But a better visualization would shade the areas based not upon who won the state, but by the degree to which they won the state. And the states themselves shouldn't be represented as a function of their geographic size, but rather the size of their population. Here we have just such a picture, and its clear, we are all purple now. More can be found here.

Wednesday, October 29, 2008

Tuesday, October 28, 2008

Greg Mankiw on the Presidential Candidate's Marginal Tax Rates

I'm with him:

The bottom line: If you are one of those people out there trying to induce me to do some work for you, there is a good chance I will turn you down. And the likelihood will go up after President Obama puts his tax plan in place. I expect to spend more time playing with my kids. They will be poorer when they grow up, but perhaps they will have a few more happy memories.

Sunday, October 26, 2008

Privatizing Education

Estimating Returns to Schooling from State-Level Data: A Macro-Mincerian Approach

In this paper, we use information from U.S. states to determine the social return to schooling. We estimate a macro-Mincerian model where aggregate earnings (or income) depend upon physical capital, labor, average years of schooling and average labor force experience. We find that the social return to U.S. schooling is 9 to 16 percent, which matches estimates of the private return found in the labor literature. Our results therefore provide evidence that U.S. schooling is indeed productive, but generates no positive externalities.

Friday, October 24, 2008

Economics Student Discussion

Monday, October 20, 2008

Visualization

Economics Student Discussion

I propose an initial meeting time of 4:30pm on Wednesday, October 22 in room 257 in the Cartwright Center. If you are interested, join the Facebook group ‘UW-L Economics Students’ or email me.

If you have a specific question or an article to discuss, bring it with you.

Kathryn Birkeland

birkelan.kath@uwlax.edu

Sunday, October 19, 2008

Can A President Tame the Business Cycle?

Monday, October 13, 2008

2008-2009 Seminars

October 10-Kristen Monaco, Cal State Long Beach, Wages and working conditions of truck drivers at the ports of Long Beach and Los Angeles

November 7-Mike Wenz, Winona State, Is there status quo bias? Evidence from two point conversions in football

November 21- James Murray, Viterbo, Initial Expectations in New Keynesian Models with Learning

December 5- Glenn Knowles and Keith Sherony, UWL, A Tale of Two Teams: A Comparison of the Cubs & Sox in Chicago

March 6- Cara McDaniel, Kenyon College, A Study of Hours Worked in the OECD Countries

March 27- Russell Cooper, University of Texas, Macroeconomics

April 17- Scott Cunningham, Baylor, The Internet and Prostitution

May 1- Taggert J. Brooks, UWL, In Da Club: An Econometric Analysis of Strip Club Patrons

Wednesday, October 8, 2008

Problem Definition

The greatest challenge to any thinker is stating the problem in a way that will allow a solution.It's why we spend so much time on Problem Definition in BUS 230.

Bertrand Russell

British author, mathematician, & philosopher (1872 - 1970)

Sunday, October 5, 2008

Bailout Plan Summary

http://money.cnn.com/2008/10/03/news/economy/house_bill_summary/

Friday, October 3, 2008

Like Guitar Hero, but for Economists!

Wednesday, October 1, 2008

Reading Research

Seminar: Kristen Monaco

Abstract:

Using data from surveys conducted in 2004 and 2006, we examine the work and earnings of drayage drivers at the Ports of Los Angeles and Long Beach. Though possessing relatively low levels of education (most have a high school diploma or less), these drivers average approximately $35,000 in earnings net of truck expenses, working, on average, 11.2 hours of work per day. Owner operators experience increased net earnings once their trucks are fully paid for, leading them to buy older, more polluting trucks. This negative externality is currently being addressed by both Ports enacting new regulations regarding truck drayage in Southern California.

Tuesday, September 30, 2008

Credit Crisis Timeline

http://www.cnbc.com/id/26885751

Monday, September 22, 2008

How Three Economists View a Financial Rescue Plan

Presentation by Nobel Laureate Edward C. Prescott

You have a wonderful opportunity to hear Professor Edward C. Prescott discuss the global economy. Professor Prescott was awarded the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel in 2004 for his joint contributions with Dr. Finn Kydland. Their work started the transformation of macroeconomics from large sets of complicated equations into models that have foundations in the choice theory of microeconomics.

Professor Prescott’s presentation is titled “Global Outlook: An Optimistic View.” He will speak at Viterbo University Monday, Sept. 29 at 7:30 p.m. in the Fine Arts Center Lobby. The event is free and open to the public.

Viterbo has a press release about the event at http://www.viterbo.edu/news.aspx?id=39694

The College Issue

A couple of articles are particularly interesting, one is on student evaluations and their role in the professor's career and the other explores a few online (video) lectures.

Enjoy!

Wednesday, September 17, 2008

Spending

How people spend their discretionary income – the cash that goes to clothing, electronics, recreation, household goods, alcohol – depends a lot on where they live. People in Greece spend almost 13 times more money on clothing as they do on electronics. People living in Japan spend more on recreation than they do on clothing, electronics and household goods combined. Americans spend a lot of money on everything.

Sunday, September 14, 2008

NPR Report: Sales Soar For Shoes, Glasses Like Palin's

Listen to the full report here: http://www.npr.org/templates/story/story.php?storyId=94545630&ft=1&f=3

Tax Math

Douglas Holtz-Eakin, a former Director of the Congressional Budget Office and current chief McCain economic advisor, is an honest man--which means he's something of a liability on the Straight Talk Express. A few months ago, he admitted to my colleague, Michael Scherer, that Barack Obama's economic plan would reduce taxes for most people. And now, in a forthcoming book by Fortune columnist Matt Miller, he makes it clear that the next President is going to have to raise taxes.And the futures market is also betting on rising taxes according to Mankiw.

"If you do nothing on the spending side, you're going to have to raise taxes whether you're a Republican, a Democrat or a Martian," he tells Miller...and then he immediately makes it clear that the "spending side" part of the argument is nothing more than a political fig-leaf.

The top income tax rate is now 35 percent. According to the betting at Intrade, the probability that the top income tax rate in 2011 will exceed 38 percent is 0.87. Call this P(tax hike).

Barack Obama has made such a tax hike part of his campaign promises, and there is no reason to think the Congress won't deliver for him. So let's assume Obama is certain to get the tax hike if he wins. That is, P(tax hike / Obama) = 1.0. (If this assumption is wrong, and this conditional probability is less than one, then my conclusion below would be even stronger.)

According to Intrade, the probability of Obama being the next president is 0.53. Call this P(Obama). And P(McCain) = 0.47.

Now we can calculate the probability of a tax hike conditional on McCain winning. It comes from the formula

P(tax hike)

= P(tax hike/Obama) P(Obama) + P(tax hike/McCain) P(McCain),

and plugging in the above numbers. It tells us that

P(tax hike / McCain) = 0.74.

Sunday, September 7, 2008

Google Advice to Students

Our Googley advice to students: Major in learning

7/15/2008 05:48:00 PM

Management guru Peter Drucker noted that companies attracting the best knowledge workers will "secure the single biggest factor for competitive advantage." We and other forward-looking companies put a lot of effort into hiring such people. What are we looking for?

At the highest level, we are looking for non-routine problem-solving skills. We expect applicants to be able to solve routine problems as a matter of course. After all, that's what most education is concerned with. But the non-routine problems offer the opportunity to create competitive advantage, and solving those problems requires creative thought and tenacity.

Here's a real-life example, a challenge a team of our engineers once faced: designing a spell-checker for the Google search engine. The routine solution would be to run queries through a dictionary. The non-routine, creative solution is to use the query corrections and refinements that other users have made in the past to offer spelling suggestions for new queries. This approach enables us to correct all the words that aren't in the dictionary, helping many more users in the process.

How do we find these non-routine savants? There are many factors, of course, but we primarily look for ...

... analytical reasoning. Google is a data-driven, analytic company. When an issue arises or a decision needs to be made, we start with data. That means we can talk about what we know, instead of what we think we know.

... communication skills. Marshalling and understanding the available evidence isn't useful unless you can effectively communicate your conclusions.

... a willingness to experiment. Non-routine problems call for non-routine solutions and there is no formula for success. A well-designed experiment calls for a range of treatments, explicit control groups, and careful post-treatment analysis. Sometimes an experiment kills off a pet theory, so you need a willingness to accept the evidence even if you don't like it.

... team players. Virtually every project at Google is run by a small team. People need to work well together and perform up to the team's expectations.

... passion and leadership. This could be professional or in other life experiences: learning languages or saving forests, for example. The main thing, to paraphrase Mr. Drucker, is to be motivated by a sense of importance about what you do.

These characteristics are not just important in our business, but in every business, as well as in government, philanthropy, and academia. The challenge for the up-and-coming generation is how to acquire them. It's easy to educate for the routine, and hard to educate for the novel. Keep in mind that many required skills will change: developers today code in something called Python, but when I was in school C was all the rage. The need for reasoning, though, remains constant, so we believe in taking the most challenging courses in core disciplines: math, sciences, humanities.

And then keep on challenging yourself, because learning doesn't end with graduation. In fact, in the real world, while the answers to the odd-numbered problems are not in the back of the textbook, the tests are all open book, and your success is inexorably determined by the lessons you glean from the free market. Learning, it turns out, is a lifelong major.

Wednesday, September 3, 2008

J-Term Opportunity

FOCUS: Social Responsibility, Ethical Globalization, Service Learning

Students will come face to face with crucial issues about globalization and its impact on communities to better understand them and see socially responsible business and other grassroots solutions in action.

More detailed information can be found at: http://www.uwlax.edu/faculty/anderson/information%20Tanzania%208-27-08.doc

(See also UWL's Study Abroad Link to J-Term Offerings)

Contact Professor Donna Anderson and/or attend one of the information sessions:

INFORMATIONAL MEETINGS

DATES: Sept 10 and Sept 22, 2008

TIME: 6:00pm

LOCATION: Ward Room, Cartwright

Congratulations

Tuesday, July 22, 2008

Politics and Economists

http://gregmankiw.blogspot.com/2008/07/how-to-win-economist-vote.html

Monday, May 5, 2008

Interactive Inflation

Saturday, April 26, 2008

Tuesday, April 8, 2008

The Monty Hall Problem

Thursday, April 3, 2008

Visualizing Economics

Check out Visualizing Economics: Making the Invisible Hand Visible.

Saturday, March 29, 2008

Expanding Power

http://www.bloomberg.com/apps/news?pid=20601068&sid=aZ8kIhVPApw8&refer=home

The proposal includes combining the Office of the Comptroller of the Currency and the Office of Thrift Supervision, transferring state bank regulation to the FDIC, and expanding the Fed's legislated "lender of last resort" function.

It also includes the establishment of three new regulators: the prudential financial regulator, the business conduct regulator, and the corportate finance regulator.

Some would assert that a reason behind the current financial turmoil was the increased regulations on banks that created incentives to expand the use of these new financial derivatives. So regulation may have gotten us into this, but let's see if it can get us out of this.

Let me know what you think.

Monday, March 17, 2008

What happend to the Bear?

Some of the trouble for Bear Stearns stemmed from the Global Legal Settlement of 2002 in which the 10 largest investment banks were barred from combining research and underwriting activities and required to pay substantial fines. Bear Stearns' original fines were approximately $80 million. The investment bank did have some insurance to help with the penalties except they management of Bear Stearns signed the Settlement agreement without talking to its insurers first as their contract stated. So there was $45 million of the penalty that Bear expected would come from insurers, but the insurers felt they hadn't been given sufficient notice. So, the two sides went to court.

Late last week, a NY appeals court ruled that the insurance companies were not responsible for that $45 million. So, Bear Stearns would now have to pay the $45 million penalty out of their own pockets. Worried that the investment bank would not be able to do so, shareholders got out fast. It was a fire sale on Bear Stearn shares dropping from a price of $68 per share on Tuesday, to under $30 per share on Friday to a buyout by JP Morgan on Sunday for $2 per share.

The problem for Bear Stearns is the same as all firms in today's securities markets - asymmetric information. Savers are having a hard time determining the risk of banks, investment banks, and publicly traded companies. With an increase in uncertainty comes an increase in the lemons problem. Without being able to tell stable investment banks from unstable, savers choose to pull back their lending.

The risk that this will spread is high. The increase in adverse selection problems after Bear Stearns has stopped most bank-to-bank lending. The interbank and federal funds markets are not functioning well. Those banks with reserves to lend are holding on to them for fear of getting a lemon.

Fighting a Financial Crisis

In an attempt to calm the financial markets after the essential collapse of Bear Stearns, the Fed has extended this safety net to investment banks as well. At the same time, the Fed lowered the discount rate to 3.25% only 25 basis points above the current federal funds target although the target is expected to be lowered at the meeting on Tuesday. It is not clear how long the Fed expects to maintain this reduction in the premium on discount loans.

Investment banks are large players in the smooth functioning of financial markets. Until this new lending facility from the Fed, these investment houses did not have a government safety net. I believe the Fed is hoping that the availability of support from the Fed will decrease the uncertainty plaguing these investment banks to the extent that the loans will not even be needed. After all, the last time the Fed took steps to extend the discount window was when the markets tumbled after September 11, 2001. The availability of support from the Fed was enough to calm the market and very few loans were actually extended.

The fundamental question: Will all this frantic activity by the Fed instill confidence or increase uncertainty?

Let me know what you think.

Wednesday, March 12, 2008

If at first you don't succeed, try, try again.

On Friday, the Fed also increased its Term Auction Facility by $100 Billion. The drawback of the TAF is that the FOMC must conduct open market operations to offset the decrease in the federal funds rate from more reserves in the banking system. With the TSLF, the Fed is aiming to ease liquidity problems without pumping cash into the economy which fuels inflation.

This new facility will allow banks some liquidity with respect to mortgage backed securities since the market for these securities has precious few buyers lately. Although it increases liquidity, it does not alleviate the underlying adverse selection problem that has caused banks to pull back their lending. It most likely will not lead to looser lending practices. Therefore it's unlikely to help businesses struggling to find funds for investment.

At the same time, the Fed's announcement of this new tool a week before their next FOMC meeting would suggest a smaller cut in the federal funds target. This would ease inflationary pressures but would be unwelcome in the stock market.

At the very least, we can be optimistic that they're still trying.

Sunday, March 2, 2008

Career Advice

Hal Varian tells the kids what to study

Q: Your job sounds extremely interesting. What jobs would you recommend to a young person with an interest, and maybe a bachelors degree, in economics?

A: If you are looking for a career where your services will be in high demand, you should find something where you provide a scarce, complementary service to something that is getting ubiquitous and cheap. So what’s getting ubiquitous and cheap? Data. And what is complementary to data? Analysis. So my recommendation is to take lots of courses about how to manipulate and analyze data: databases, machine learning, econometrics, statistics, visualization, and so on.

Friday, February 29, 2008

Seminar

Wednesday, February 20, 2008

Making Economics Relevant Again

The author set out to find, who among economists was "using economics to make the world a better place?"

Here's what he found:

"I received dozens of diverse responses, but there was still a runaway winner. The small group of economists who work at the Jameel Poverty Action Lab at M.I.T., led by Esther Duflo and Abhijit Banerjee, were mentioned far more often than anyone else.

Ms. Duflo, Mr. Banerjee and their colleagues have a simple, if radical, goal. They want to overhaul development aid so that more of it is spent on programs that actually make a difference. And they are trying to do so in a way that skirts the long-running ideological debate between aid groups and their critics."

Friday, February 15, 2008

Internationalizing Intermediate Microeconomics

Here's a review of an article that the blogauthor links us to on how to improve students' learning and motivation.

“This paper describes an internationally-oriented course module for intermediate microeconomics.We describe the collaboration project as well as the results of implementing it at an US and Peruvian university. In the project, US university students were partnered with comparable students at a Peruvian university to complete a project using web-based learning tools and internet conferencing.

Project learning objectives are identified and an outline of the project and assignments is presented. Based on our experiences,we evaluate the project and consider problems and issues that arose. Our results suggest that the current state of web-based technology affords university students many opportunities to productively collaborate with their international counterparts.”

Wednesday, February 13, 2008

Worldmaps With Themes

It provides world maps with about 64 different themes like Aid, Business Integrity and Corruption, Child Soldiers, Child Labor, Female Rights, Financial Inclusion, Digital Inclusion, Debt, Natural Disasters' Economic Losses, Trafficking ... Each map is accompanies with detailed explanations, analysis and additional information. The site also provides movies on some countries, regions and global issues.

Tuesday, February 12, 2008

Debit cards for everyone!

Monday, February 11, 2008

The cost of making money

The piece also addresses the additional time costs of using pennies in transactions and the possible inflation if the US were to abolish the penny.

The clip is about 10 minutes long.

Should We Make Cents?

http://www.cbsnews.com/sections/i_video/main500251.shtml?id=3814132n

CBS News Online

Friday, February 1, 2008

Seminar

Jarod will be presenting: Strategic Market Games with Bayesian Learning

Faculty advisor: Dr. Barb Bennie

We study a game theoretic economic model involving symmetric agents who compete by bidding to purchase goods in a series of stages. The production of the good is assumed to be from an unknown distribution. Each agent bids according to the Nash equilibrium strategy that incorporates the history of observed production. As more information is obtained, the agents learn more about the unknown distribution by way of Bayesian learning. We compare the expected inflation rate for each stage to the infation rate when the production distribution is known, which is established by the Fisher equation. When the production distribution is unknown, the expected inflation deviates from results of the Fisher equation. Although as more is learned about the unknown distribution over time, the expected infation converges to the infation rate determined by the Fisher equation.

Thursday, January 31, 2008

The Economics of Repugnance

Here's the introduction:

You can kill a horse to make pet food in California, but not to feed a person. You can hoist a woman over your shoulder while running a 253-meter obstacle course in the Wife-Carrying World Championship in Finland, but you can’t hold a dwarf-tossing contest in France. You can donate a kidney to prevent a death and be hailed as a hero, but if you take any money for your life-saving offer in the United States, you’ll be jailed.

These prohibitions are not imposed because of concerns about health or safety or unfair practices, some economists say, but because people tend to find such activities repugnant. In other words, just hearing about them can cause a queasy sensation in the pit of your stomach.

People don’t pay enough attention to how repugnance affects decisions about what can be bought and sold, asserts Alvin Roth, an economist at Harvard University.

Interestingly, one of the conclusions is: Often introducing money into the exchange — putting it into the marketplace — is what people find repugnant. Mr. Bloom asserted that money is a relatively new invention in human existence and therefore “unnatural.”

Friday, January 18, 2008

Normative vs. Positive

Tyler Cowen calls Dani Rodrik on the former:

Steven Landsburg writes:

Even if you’ve just lost your job, there’s something fundamentally churlish about blaming the very phenomenon that’s elevated you above the subsistence level since the day you were born. If the world owes you compensation for enduring the downside of trade, what do you owe the world for enjoying the upside?

Progressive taxation, some would say in response!

Tim Harford, however, nails it:

...people lose their jobs all the time for reasons that have nothing to do with foreign trade. I'd argue that they deserve some help. Why are jobs lost to foreign competition so privileged?

I am most interested in Dani Rodrik on the same, most of all when writes:

The question of how we should respond to a trade-induced change in income distribution is not one on which economists can offer any expertise. This is a question about ethics, values, and norms, none of which is part of an economist's training. Landsburg's take on this is as good as mine--which is as good as that of any person on the street.

Every now and then I feel a deep responsibility to rebut an argument. In my view anyone doing policy economics has an obligation to learn more about ethics -- much more -- than the guy in the street would know. Would someone doing experimental economics feel free of the obligation to learn some empirical psychology? Would someone doing trade feel free of the obligation to learn some trade law, some history, and some political science? No. What's the difference? Economists like to separate the "positive" and "normative" aspects of what they do, but this distinction has not much impressed the moral philosophers who have looked at it nor has it impressed Amartya Sen. The very decision to use economic tools emphasizes some considerations and excludes others. The final policy analysis is not just pure prediction but rather it is also an implicit presentation and weighting of both different kinds of information and different values. So if you are doing policy economics, it is imperative that you think about ethics at a very deep level, and read widely in ethics. You are doing ethics whether you like it or not! Furthermore I don't doubt that Dani already has a deeper understanding of ethics than the (often very crude) man in the street.

That said, I don't agree with the ethics Dani does discuss, noting that he must have felt he had some good reason to put forward the concerns he did and not others. (As a rule of thumb I'll note that those who profess the impassability of ethical terrain have just in fact traversed it.) I don't worry much about the procedural fairness if a poor country trades at better prices by paying its labor less or by polluting. Low wages are precisely the wages we want to see bid up, and if there is a concern for the losers I would not call the issue a procedural one but rather one of outcomes. And pollution can be a moral crime but attacking trade is not usually a good way to go after it. Tax the pollution, not the trade.

Wednesday, January 16, 2008

Dieting for Dollars

How can economics help you loosing weight? Tuesday's, January 15, NPR's Talk of the Nation broadcast explained how. Specifically, Richard McKenzie an economics professor from UC-Irvine explained how he had entered into a contract with a friend to pay her $500 if he had not lost ten pounds after ten weeks. The broadcast was a follow up on McKenzie's recent article in the Wall Street Journal. The show was a lively discussion with the host and callers about dieting and economic principles.